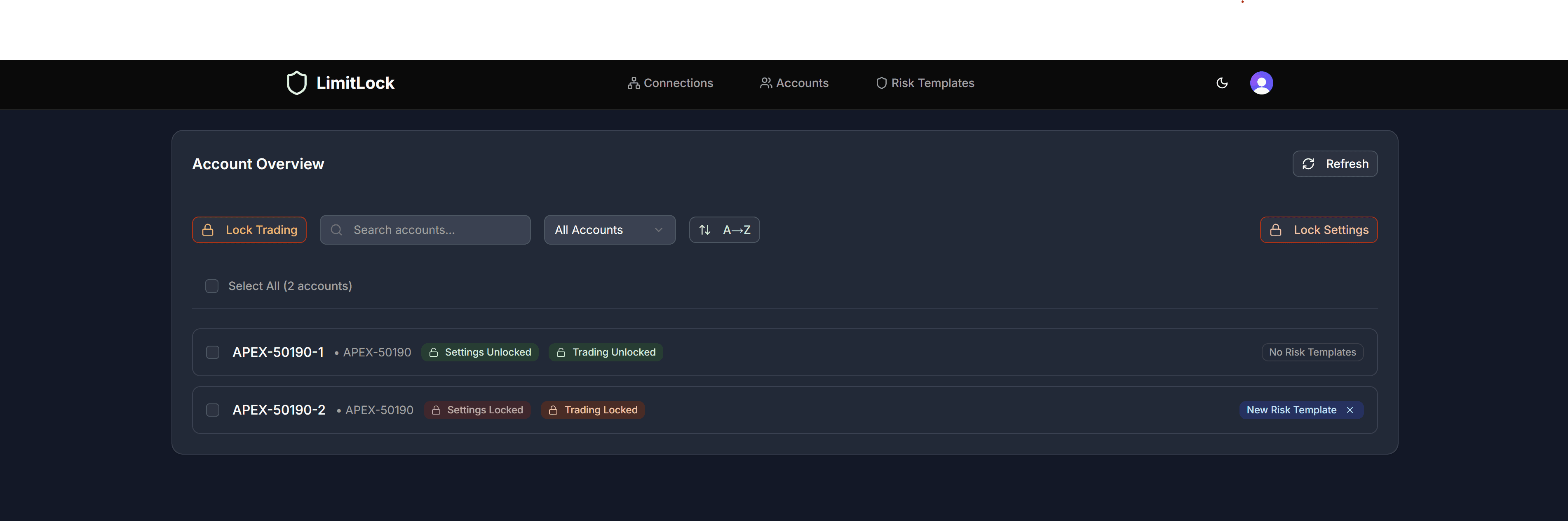

Powerful Risk Management Features for Rithmic

Maximum Loss Protection

Every professional trader has a daily loss limit. The difference? They stick to it. LimitLock ensures you honor your risk parameters, even when markets get volatile or emotions run high.

- Real-time position monitoring

- Automatic trade liquidation when limits exceeded

- Customizable risk thresholds

Why Choose Us

Capital Protection

While Rithmic lets you disable max loss limits mid-session, Limit Lock enforces them until session end. No emotional overrides when trades go south.

Consistency

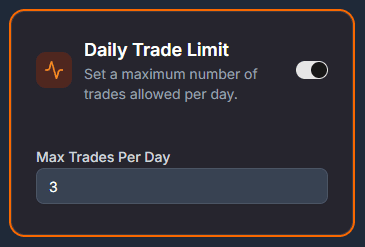

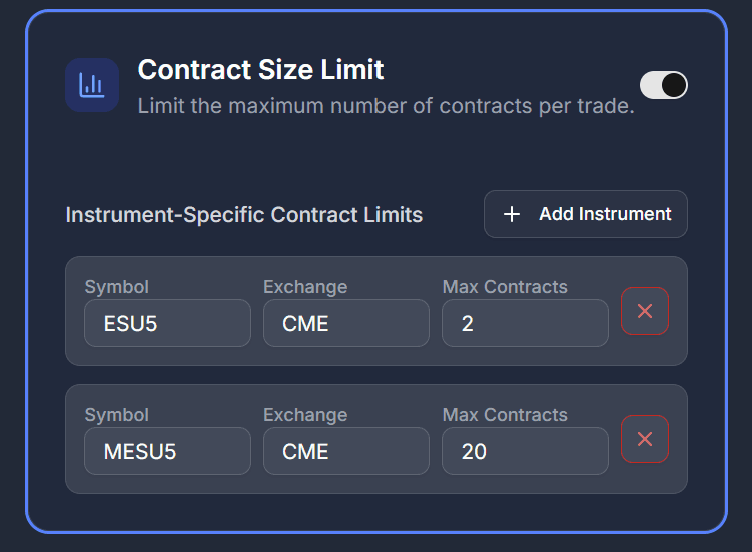

Position sizing is where most traders fail. LimitLock keeps your max position size fixed. Consistent sizing, consistent results.

Professional Edge

Trade like institutions do—with non-negotiable risk parameters. While retail traders negotiate with themselves, you'll operate with hedge fund discipline.

Trading Discipline

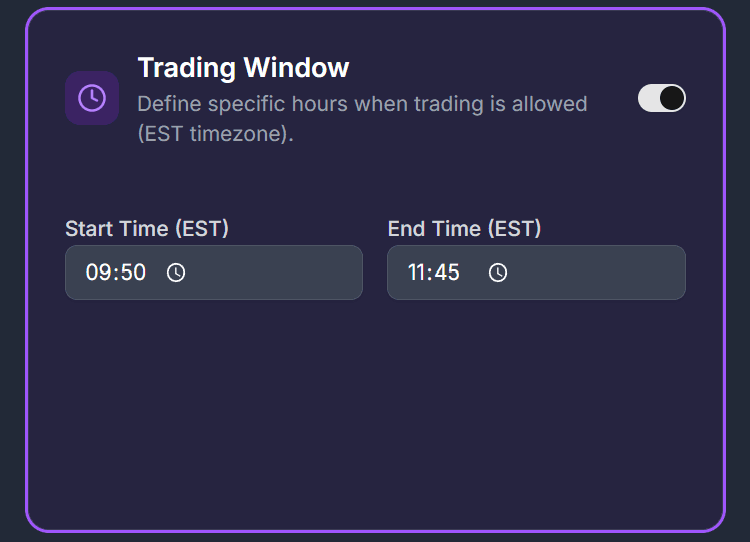

Enforce your trading plan and prevent emotional decision-making with automated rules.

Choose Your Plan

Select the plan that fits your trading needs and scale as you grow.

- 1 Trading Account

- Basic Risk Rules

- Maximum Loss Protection

- Position Size Control

- Email Support

- Up to 5 Trading Accounts

- Advanced Risk Rules

- Trading Windows

- Real-time Risk Alerts

- Risk Templates

- Priority Support

- Unlimited Trading Accounts

- Custom Risk Rules

- Advanced Analytics

- Multi-User Management

- API Access

- Dedicated Account Manager